All Categories

Featured

Table of Contents

- – What is Level Term Life Insurance Policy? How ...

- – What is the Function of What Is A Level Term L...

- – What is Term Life Insurance With Level Premiu...

- – What is Simplified Term Life Insurance? Under...

- – What is the Function of Term Life Insurance ...

- – What is Term Life Insurance With Accelerated...

- – What is Level Term Life Insurance Definition...

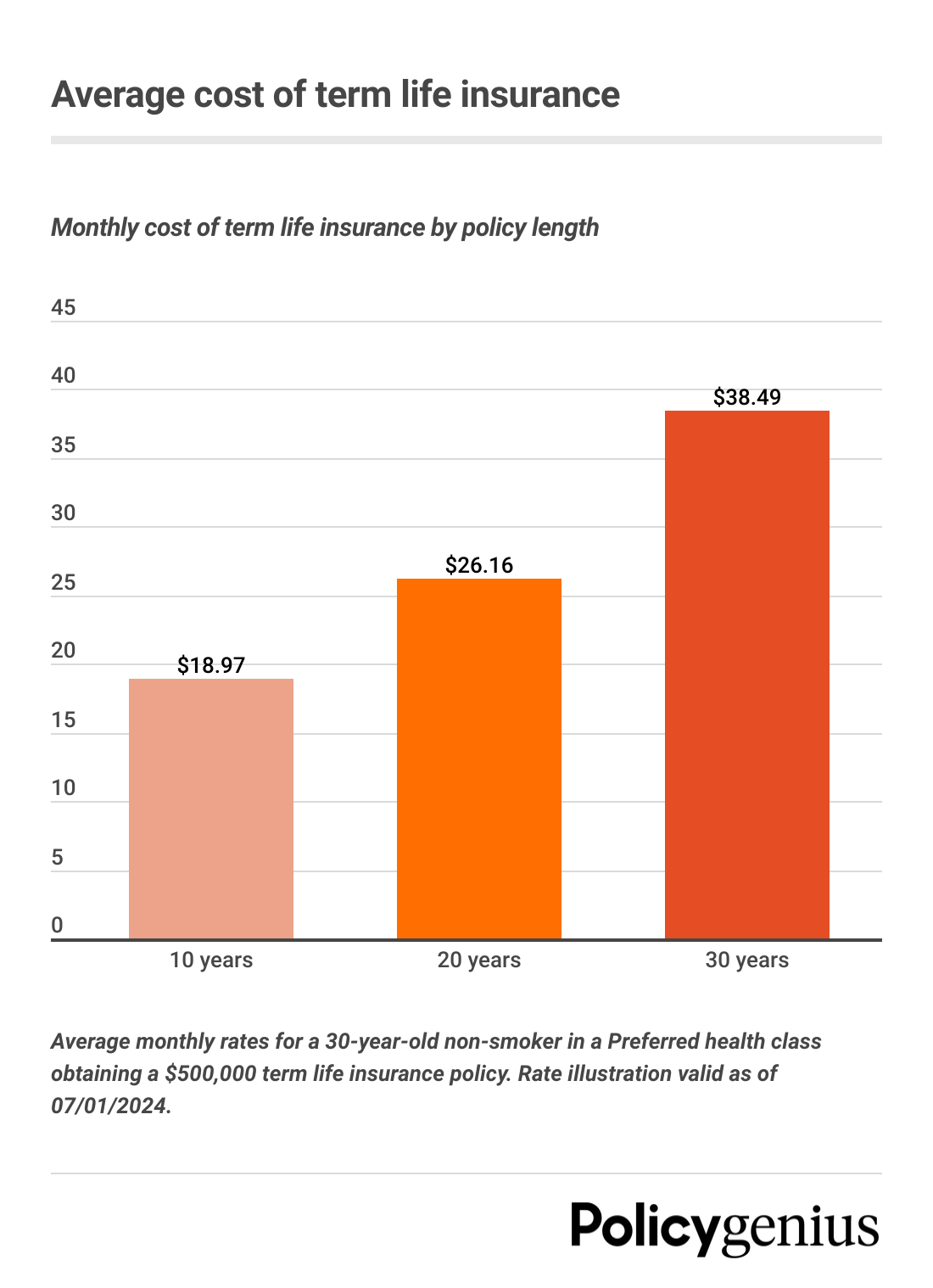

With this sort of level term insurance plan, you pay the exact same month-to-month premium, and your recipient or recipients would certainly get the exact same advantage in the occasion of your death, for the whole protection period of the plan. Exactly how does life insurance work in terms of cost? The expense of level term life insurance coverage will depend upon your age and health and wellness along with the term length and insurance coverage quantity you choose.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Female$1,000,00030$43.3135 Man$500,00020$20.7235 Woman$750,00020$23.1340 Male$600,00015$22.8440 Lady$800,00015$27.72 Estimate based on rates for qualified Sanctuary Simple applicants in superb wellness. Pricing distinctions will vary based on ages, health standing, coverage quantity and term length. Place Simple is currently not available in DE, ND, NY, and SD. Despite what coverage you choose, what the policy's cash money value is, or what the round figure of the survivor benefit becomes, comfort is amongst the most useful benefits related to buying a life insurance policy policy.

Why would certainly a person choose a plan with an annually eco-friendly premium? It might be an option to take into consideration for someone that requires protection only temporarily. A person who is in between tasks yet desires death benefit protection in location since he or she has financial obligation or other financial responsibilities may want to consider an every year renewable plan or something to hold them over till they begin a brand-new job that uses life insurance policy.

What is Level Term Life Insurance Policy? How It Works and Why It Matters?

You can generally restore the policy each year which gives you time to consider your choices if you desire insurance coverage for longer. That's why it's useful to buy the right quantity and length of insurance coverage when you first get life insurance, so you can have a reduced price while you're young and healthy.

If you add essential overdue labor to the family, such as child care, ask on your own what it may cost to cover that caretaking job if you were no more there. After that, ensure you have that protection in location so that your family members obtains the life insurance policy benefit that they require.

What is the Function of What Is A Level Term Life Insurance Policy?

For that established amount of time, as long as you pay your costs, your price is steady and your recipients are shielded. Does that imply you should constantly choose a 30-year term length? Not always. As a whole, a shorter term policy has a reduced costs price than a much longer plan, so it's wise to choose a term based upon the predicted length of your monetary responsibilities.

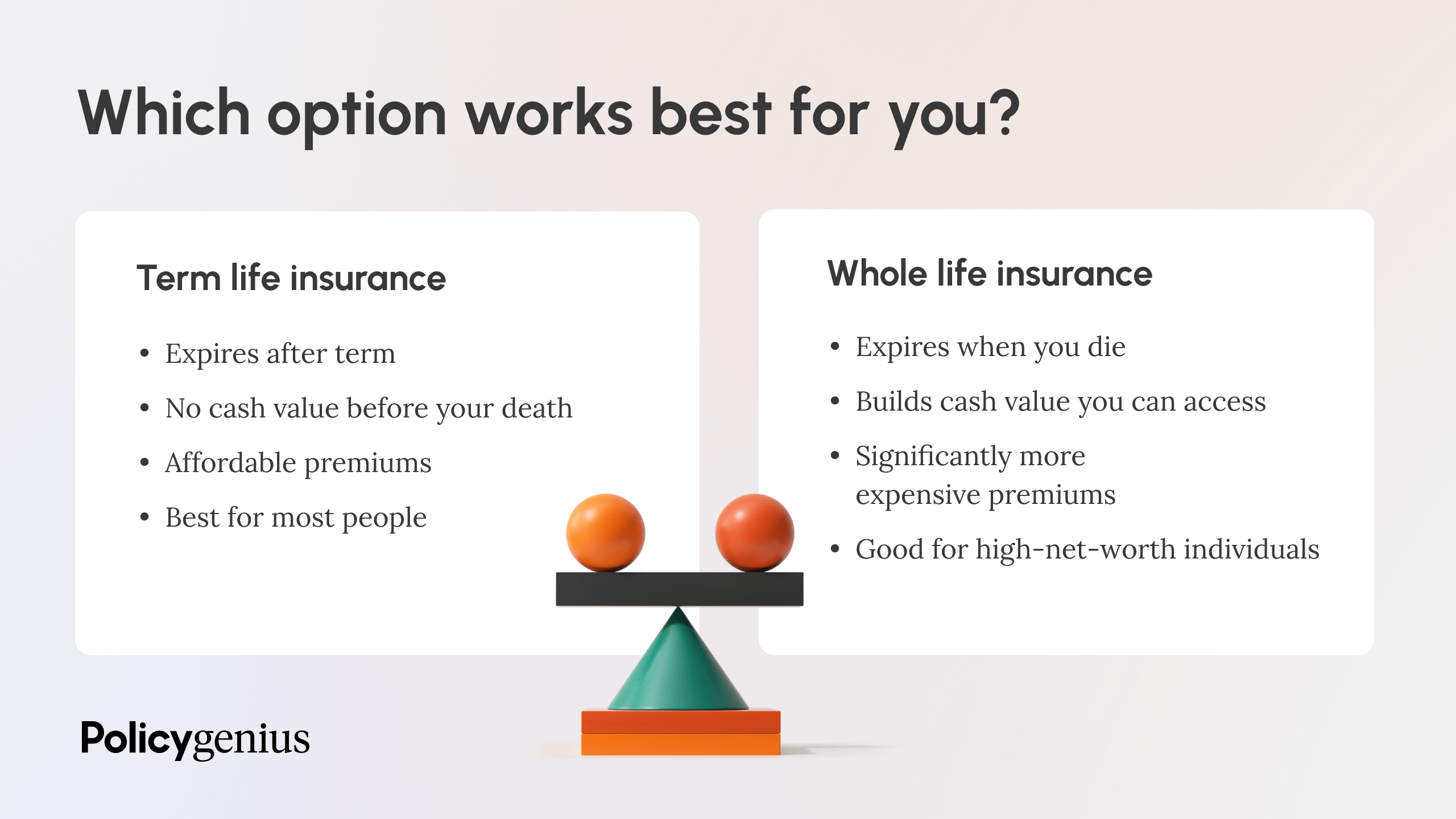

These are all essential elements to maintain in mind if you were considering selecting a long-term life insurance policy such as a whole life insurance policy plan. Numerous life insurance policy policies offer you the choice to add life insurance policy bikers, think added benefits, to your plan. Some life insurance policy plans include riders integrated to the price of premium, or motorcyclists might be available at a cost, or have actually fees when exercised.

What is Term Life Insurance With Level Premiums? The Key Points?

With term life insurance policy, the communication that many people have with their life insurance policy company is a month-to-month costs for 10 to thirty years. You pay your regular monthly premiums and hope your household will never ever need to utilize it. For the group at Haven Life, that looked like a missed opportunity.

Our team believe browsing choices about life insurance policy, your individual finances and general wellness can be refreshingly basic (20-year level term life insurance). Our material is produced for academic objectives just. Sanctuary Life does not endorse the companies, products, solutions or strategies talked about right here, however we hope they can make your life a little much less hard if they are a fit for your situation

This material is not intended to provide, and ought to not be depended on for tax, lawful, or financial investment suggestions. Individuals are motivated to seed guidance from their own tax or legal advice. Learn More Place Term is a Term Life Insurance Policy Policy (DTC and ICC17DTC in specific states, including NC) issued by Massachusetts Mutual Life Insurance Coverage Business (MassMutual), Springfield, MA 01111-0001 and used exclusively with Sanctuary Life insurance policy Agency, LLC.

Ideal Company as A++ (Superior; Top group of 15). The rating is since Aril 1, 2020 and undergoes transform. MassMutual has actually obtained different ratings from various other ranking companies. Place Life And Also (And Also) is the advertising name for the Plus cyclist, which is included as component of the Haven Term policy and uses access to extra solutions and advantages at no charge or at a price cut.

What is Simplified Term Life Insurance? Understanding Its Purpose?

Discover much more in this overview. If you depend upon a person monetarily, you may ask yourself if they have a life insurance policy plan. Discover how to find out.newsletter-msg-success,. newsletter-msg-error display screen: none;.

When you're more youthful, term life insurance policy can be a straightforward way to shield your enjoyed ones. As life adjustments your monetary top priorities can as well, so you may want to have whole life insurance policy for its lifetime coverage and added benefits that you can use while you're living. That's where a term conversion is available in.

What is the Function of Term Life Insurance Level Term?

Authorization is ensured no matter your wellness. The costs will not enhance when they're set, however they will certainly rise with age, so it's a good idea to secure them in early. Learn extra concerning how a term conversion works.

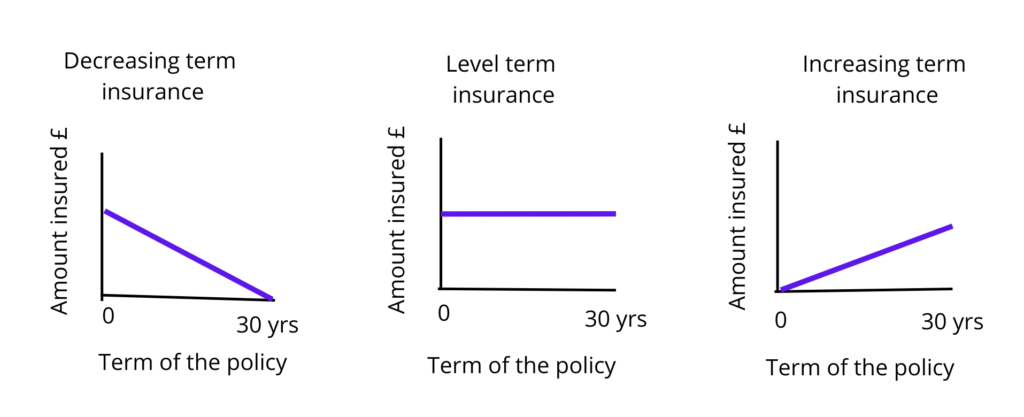

The word "level" in the expression "level term insurance" implies that this kind of insurance coverage has a fixed costs and face quantity (survivor benefit) throughout the life of the policy. Just placed, when people discuss term life insurance policy, they usually refer to level term life insurance policy. For the majority of individuals, it is the simplest and most economical selection of all life insurance coverage types.

What is Term Life Insurance With Accelerated Death Benefit? Your Essential Questions Answered?

Words "term" right here refers to a provided number of years throughout which the degree term life insurance policy stays energetic. Degree term life insurance policy is one of the most popular life insurance policy plans that life insurance service providers offer to their clients as a result of its simpleness and price. It is likewise simple to compare degree term life insurance policy quotes and obtain the most effective costs.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. affordable life insurance for young families from agents. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

The system is as complies with: Firstly, choose a plan, fatality benefit amount and plan period (or term size). Choose to pay on either a monthly or annual basis. If your early death takes place within the life of the plan, your life insurance firm will certainly pay a swelling sum of fatality advantage to your predetermined recipients.

What is Level Term Life Insurance Definition Coverage?

Your degree term life insurance coverage plan expires as soon as you come to the end of your policy's term. Option B: Buy a brand-new degree term life insurance plan.

1 Life Insurance Coverage Data, Information And Market Trends 2024. 2 Price of insurance policy prices are determined utilizing methodologies that differ by business. These rates can differ and will usually enhance with age. Prices for active employees may be various than those offered to terminated or retired employees. It is necessary to take a look at all elements when reviewing the overall competitiveness of rates and the worth of life insurance coverage.

Table of Contents

- – What is Level Term Life Insurance Policy? How ...

- – What is the Function of What Is A Level Term L...

- – What is Term Life Insurance With Level Premiu...

- – What is Simplified Term Life Insurance? Under...

- – What is the Function of Term Life Insurance ...

- – What is Term Life Insurance With Accelerated...

- – What is Level Term Life Insurance Definition...

Latest Posts

Funeral Insurance For Over 70

Funeral Funds For Seniors

Group Funeral Insurance

More

Latest Posts

Funeral Insurance For Over 70

Funeral Funds For Seniors

Group Funeral Insurance