All Categories

Featured

Table of Contents

It allows you to budget and prepare for the future. You can easily factor your life insurance into your spending plan since the costs never ever transform. You can prepare for the future simply as conveniently due to the fact that you understand precisely just how much cash your loved ones will certainly receive in the occasion of your lack.

This is real for individuals that gave up cigarette smoking or who have a health and wellness problem that fixes. In these situations, you'll usually need to go through a new application procedure to get a far better price. If you still need insurance coverage by the time your degree term life policy nears the expiry date, you have a few choices.

Most level term life insurance policy policies feature the option to restore coverage on an annual basis after the first term ends. term life insurance with accidental death benefit. The price of your policy will certainly be based upon your current age and it'll enhance each year. This might be an excellent choice if you just require to prolong your protection for a couple of years or else, it can obtain expensive pretty swiftly

Level term life insurance policy is one of the cheapest coverage alternatives on the marketplace since it provides fundamental security in the kind of survivor benefit and just lasts for a set time period. At the end of the term, it ends. Entire life insurance, on the various other hand, is significantly a lot more costly than level term life because it doesn't run out and features a cash worth feature.

Sought-After The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

Rates might differ by insurance provider, term, coverage quantity, health course, and state. Degree term is a fantastic life insurance policy option for a lot of people, but depending on your coverage needs and individual situation, it could not be the ideal fit for you.

Yearly sustainable term life insurance policy has a term of only one year and can be restored every year. Yearly sustainable term life costs are at first less than degree term life costs, yet prices rise each time you restore. This can be an excellent option if you, for instance, have simply stop smoking and require to wait 2 or three years to request a degree term policy and be eligible for a reduced price.

The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

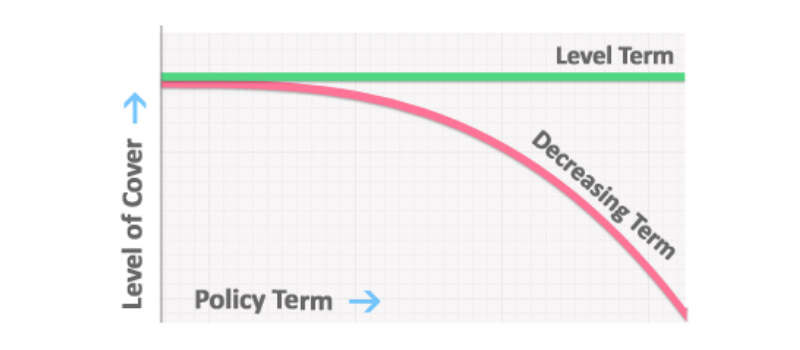

, your fatality advantage payment will decrease over time, yet your settlements will stay the same. On the various other hand, you'll pay even more upfront for less protection with an enhancing term life plan than with a degree term life policy. If you're not sure which kind of policy is best for you, working with an independent broker can help.

When you've chosen that level term is appropriate for you, the next step is to purchase your plan. Right here's exactly how to do it. Compute just how much life insurance you need Your insurance coverage quantity must attend to your family's long-term monetary needs, consisting of the loss of your earnings in the occasion of your death, in addition to financial obligations and everyday expenses.

A level premium term life insurance policy plan lets you stick to your budget while you help safeguard your family. ___ Aon Insurance Policy Providers is the brand name for the brokerage and program administration operations of Affinity Insurance Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Coverage Agency, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Coverage Providers Inc.; in CA, Aon Affinity Insurance Coverage Solutions, Inc.

The Strategy Representative of the AICPA Insurance Depend On, Aon Insurance Coverage Providers, is not connected with Prudential.

Table of Contents

Latest Posts

Funeral Insurance For Over 70

Funeral Funds For Seniors

Group Funeral Insurance

More

Latest Posts

Funeral Insurance For Over 70

Funeral Funds For Seniors

Group Funeral Insurance